During the early days of the mortgage business, brokers would require a lot of paperwork…

Guaranteed Approval Loans With Bad Credit in Canada

Now you can listen to our blog, “Guaranteed Approval Loans With Bad Credit in Canada”, while on the go.

If you’re looking for a bad credit loan, having bad credit can be a huge roadblock.

A poor credit score will not only make it more difficult to obtain authorization for a loan from a traditional lender such as a bank, but it will also mean that any loans you do acquire will not have the lowest available interest rates.

Don’t despair if you have bad credit and need a loan; there is a way!

Bad credit does not have to be a long-term issue. Let us assist you in obtaining a bad credit loan immediately!

The Benefits of a Bad Credit Loan

Banks and other traditional lending institutions frequently reject loan applications from people with negative credit and low credit scores. Extending a bad credit loan is too hazardous for them. This isn’t the end of the narrative, though. There are numerous benefits for customers seeking a loan with negative credit, which are described below.

Flexibility and Versatility

Bad credit loans, unlike other loan types, do not require the borrower to justify why they need the money. This means you can put the money towards whatever you desire!

What you use your bad credit loan for is entirely up to you, whether you’re paying off a surprising medical bill, taking a much-needed vacation, helping your kids pay for school, or fixing the brakes on your car. The bad credit loans from us provide you the option to use the money any way you want.

No Credit History

Traditional lenders insist on digging into your financial past, which is one of the drawbacks of employing them. Not only does this lengthen the process and make it take longer, but it can also affect and change your credit score in some situations (when a “hard” credit check is performed). Bad credit is not an issue with us. To compensate for any potential risk, our lenders modify their interest rates and loan quantities.

Simple to Use

If you have low credit and need a loan from a Canadian bank, you will almost always be asked to come in and meet with a loan consultant in person. This isn’t always practical. We understand that your calendar is already full of work, family, and social obligations. Thus we make obtaining a bad credit loan as simple as possible. All you need to apply is confirmation that you’re over the age of 18 and an internet connection — that’s all!

Approvals in a Flash

When it comes to traditional lenders, quick approval isn’t always their first priority, regardless of the quantity of financial aid you require. All too frequently, a bank’s primary focus is an examination. which includes a due diligence process that helps fill in the gaps in your credit history and score. Approvals for loans with bad credit can be obtained in as little as a few minutes when you have an Artificial Intelligence-assisted platform at your fingertips!

Assist in Increasing Your Credit Score

While many people who apply for bad credit loans are in a difficult financial condition, the nature of our bad credit loans means that paying back our loans responsibly and on time can actually help you improve your credit score!

There are numerous benefits to improving your credit score. But the most major changes include being able to get better rates on future loans and having an easier time getting funding from traditional lenders. Borrowers who are attentive in repaying their loans responsibly and on time can see significant gains.

Guaranteed Approval Loans in Canada

If you have low credit and want to secure a loan, your best choice is to use an online loan search engine. These loan rate comparison services operate with a variety of lenders and can assist you in shopping for a variety of lenders, including:

- Traditional financial institutions

- Credit unions are cooperative financial institutions.

- Alternative lending institutions (ALFIs)

They also provide you with access to lenders in a variety of regions, allowing you to apply from anywhere in Canada, including Alberta, Ontario (Toronto), British Columbia, Manitoba, and beyond.

3 Unsecured Loans for Bad Credit

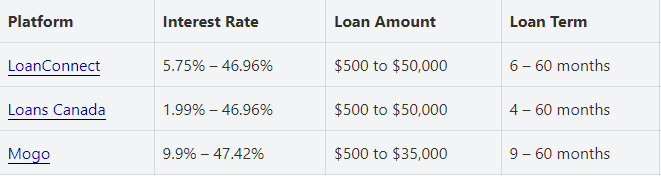

Here are the three best-guaranteed approval loans for bad credit in Canada.

1. LoanConnect

Whether you have an excellent, good, low, or bad credit score, LoanConnect is a great place to go for personal loans in Canada.

They look through numerous lenders once you fill out the application form below to obtain the best prices available.

Amount of loan: Up to $50,000

Interest rates on loans range from 5.75 percent to 46.96 percent annual percentage rate (APR).

Your interest rate is determined by your credit history, the amount of money you borrow, and the financial information you submit.

You have between 6 and 60 months to repay your loan.

Cash loans, debt consolidation loans, home renovation loans, regular personal loans, and bad credit loans are among the loan kinds accessible through LoanConnect.

2. Loans Canada

People with negative credit can apply for loans through Loans Canada’s wide lender network.

The loan can be used for a variety of things, including debt consolidation, automobile purchases, house improvements, credit enhancement, and more.

Amount of loan: Up to $50,000

The interest rate on a loan ranges from 1.99 percent to 46.96 percent.

Loan terms range from a few months to five years (60 months).

To get started, fill out the brief online application and they will contact you to find a suitable lender.

The entire procedure can be completed in as little as two business days, from application to final funding.

3. Mogo Loan

Mogo is a financial services firm that provides personal loans ranging from $500 to $35,000. They have free credit ratings, fraud protection, and a prepaid credit card.

A Mogo Liquid personal loan has a set duration and can help you pay for a variety of needs. To be eligible, you must earn at least $13,000 per year in net income.

British Columbia, Ontario, Alberta, Manitoba, New Brunswick, Newfoundland and Labrador, Nova Scotia, and Prince Edward Island are among the provinces that offer it.

- Amount of loan: $500 to $35,000

- Interest rates on loans range from 9.9% to 47.42%. APR

- Term of the loan: 9 months to 5 years

Make sure you read everything contained in the fine print before signing any loan contract. This includes the interest rate you’ll be paying, penalties for late payments, and associated costs (e.g. origination fees).

You should also clarify that they will disclose your payments to the credit agencies so that you may begin the process of rebuilding your credit.

The Bottom Line

At Lionsgate, we specialize in helping people obtain funding private mortgages for land purchases as well as for other real estate transactions. If you are looking for guaranteed approval loans, get a mortgage or apply for a loan, leave us a message and we will try to connect you with local realtors and sourcing for financing.

If you found this article helpful, please share it with someone you care about. Also, visit our blog to read similar articles on mortgages.