During the early days of the mortgage business, brokers would require a lot of paperwork…

How Much Can You Lease Farm Land For?

Now you can listen to our blog post, “How Much Can You Lease Farm Land For?” while on the go.

In the province, cash rent per tillable acre in 2018 ranged from $50 in five counties, including Prince Edward and Renfrew, to $300 in Huron, Oxford, and Perth counties. According to the report, the cost per cultivable acre varied from $3,000 in the United Counties of Leeds and Grenville to $65,000 in Peel Region. You can find the land values for each region here.

According to the article, the capitalization rate, also referred to as the “cap rate,” was also estimated by academics. These ratios represent the approximate division of net revenue by property value. Farmers can use these numbers to compare and evaluate the returns on their fields.

Farmland Lease Prices

Farmland lease prices are expected to remain the same over the next 12 months, according to the majority of respondents (48.4%), while 29.2% anticipate price increases.

In addition, respondents were questioned about how much they believed local farmers sold in the previous year in terms of a percentage. Participants reported that the median rate of farmland sold to farmers was 80%, though opinions differed by location. Farmland sales seen by farmers as a percentage ranged from 5% (Region of Peel) to 100%. (Perth County).

The researchers discovered that a producer’s likelihood to rent, lease, crop-share, or custom farm increases with the amount of farmland he or she owns.

How Much Can You Lease Farm Land For?

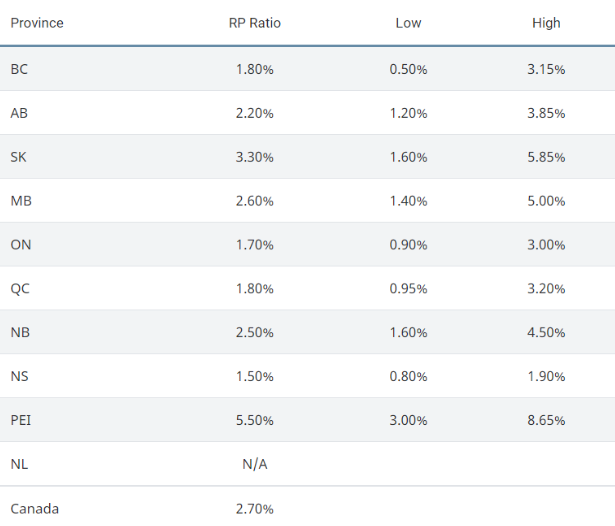

Here are the lease rates of farm land in all provinces of Canada.

The Ideal Time to Purchase or Rent Farmland

If you decide to buy property, the optimum time to buy farmland is currently a major concern for many producers.

The amount of profit more land will generate and the farming operation’s cash flow are the two factors to consider. It might not be a suitable time to buy, regardless of how reasonably priced the property is if the additional mortgage payments strain or deplete your operating resources and the higher revenues aren’t sufficient to cover the costs. You must be able to continue making payments and managing your cash flow.

You can determine whether purchasing a piece of land at the moment is a good deal or too expensive by calculating the ratio between the projected mortgage payment and the fair market land rental value. Although good ratios can differ slightly between farms, there are some fundamental guidelines to keep in mind:

Generally speaking, a ratio of 2.0 or less is a good deal.

- For most farms, a ratio of 3.0 is the breaking point.

- In general, a ratio greater than 3.0 is not a good deal.

It’s wise to remember the proverb that it takes three acres of purchased land to pay for one extra acre.

Fair Market Land Rental: What Is It? Usually, this represents between 18 and 22% of gross sales (yield per acre times price per bushel). For instance: With a three-year average price of $7 and an average wheat yield of 50 bushels, a farm’s average gross income would be $350 per acre. Fair market land rental should be between $63 and $77 per acre (typically around $66).

A land payment to the rental ratio of 2.0 would result in an acre-based land payment of $132 (based on a 25-year amortisation at a fixed rate of 6.125%) or an estimated acre-based land value of $1,668. A land payment of $198 per acre or a land value of $2,501 per acre would result from a land payment-to-rental ratio of 3.0. It is possible to estimate the relationship between the value of the land and its ability to produce. You might use this to determine if you should consider purchasing land immediately.

In this procedure, several dangers must be taken into account. These include the impact of the purchase on the important solvency ratios (debt to equity and debt to assets) and the debt service margin, declining commodity prices, rising interest rates, and declining yields (enough cash flow to make the payments comfortably).

In the prior example, a 10% decline in commodity prices would result in a $250 per acre reduction in the potential value of the land. The potential value of the land will decrease by $250 per acre for every 10% decrease in yield. A projected land value reduction of $496 per acre will result in an interest rate increase of 2.5%. This emphasises the necessity of cost-of-production analysis and risk management planning.

Need Some Extra Cash to Help Your Finances?

Are you struggling with your financial needs and need some extra cash? Lionsgate can help. Just fill out the form below, letting us know all your money or mortgage requirements, and we will find the best lender for you. Amazing thing? The process is free, and you can quit it at any time.

We have a team of experts that analyze your requirements and pick the best lender for you with prudent advice.

Note: Please give your authentic information while completing the form below.

If you found this article helpful, please share it with someone you care about. Also, visit our blog to read similar helpful articles on finance, real estate, and getting mortgages.