During the early days of the mortgage business, brokers would require a lot of paperwork…

Mogo Loans Review: 7 Things to Know

Now you can listen to our blog, “Mogo Loans Review: 7 Things to Know” while on the go.

You may have heard of Mogo because of their free credit score service, or because of their notorious high-interest loans.

whatever it was, Mogo has certainly created a name for itself in Canada.

There are a lot of reasons to check them out, especially because they have 7 different financial solutions to pick from.

We’ll go through everything Mogo has to offer in this review so you can see if there’s something for you.

7 Things to Know About Mogo

7 Things to Know About Mogo

Mogo now sells and promotes seven different products, each with its unique set of benefits.

- Credit Score: Equifax provides free access to your credit score * Updated monthly

- MogoProtect: Equifax account monitoring on a daily basis * Assistance with questionable activities $8.99 per month or $89.99 per year

- Mogo Visa Platinum Prepaid Card: 1 tree is planted for every transaction performed * 50 bits of Bitcoin are earned for every transaction

- MogoMoney: Get pre-approved without damaging your credit score for loans up to $35,000

- MogoMortgage: Online mortgage broker with low rates * Fixed and variable choices

- MogoWealth: Soon to be released

- MogoCrypto: is an investment tool that allows you to buy and trade bitcoin while also receiving a $5 welcome bonus. You’ll get $5 for each friend you refer.

Should You Avoid Mogo?

If you read personal finance forums, you’ve probably encountered some negative Mogo reviews.

The majority of them revolve around their loans, which, depending on what you’re offered, can come with exorbitant interest rates that you’ll have to pay back for years. Two of the top comments on a Reddit discussion about the company rejecting it as a payday loan.

But, with six other financial products under their belt, can Mogo’s other offerings compensate for their high-interest loans?

Advantages of Mogo

- The modern app, which combines all of its products into a single, easy-to-use dashboard.

- Equifax offers a free credit score that is updated monthly and is one of three Canadian organizations that provide this service.

- Through their MoneyClass course, they provide free money advice.

- With the coupon STAY SAFE, you can get MogoProtect for free for 6 months.

- Their prepaid card is one-of-a-kind and open to the public.

- Rates on mortgages are actually rather competitive.

- Get $5 for free to try your hand at bitcoin investment.

Disadvantages of Mogo

- High-interest loans will almost certainly leave you in a worse situation than when you started.

- It’s difficult to trust them because of their effective marketing and payday-style loans.

- It’s difficult to move on from a rough, contentious past.

Loans from Mogo

Let’s start with their loans, which are the most contentious of their offerings.

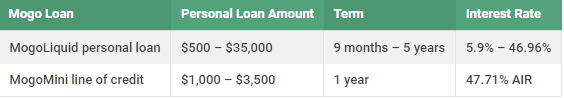

They currently provide two types of loans:

Even if you are able to secure the lowest rate available with a MogoLiquid loan, there have been reports of poor customer service as late as August 2019. According to one Reddit user, after you become a customer, your sole option for service is to use chatbots.

It’s probably best to avoid their lending service altogether, but you can take a look at it here.

Alternatives to Mogo loans

Mogo is probably one of the last places you’ll want to go if you’re searching for a loan.

One alternative is to go to your bank and inquire about their lending choices. It may not be advisable to accept the first offer they make, but it will give you a fair idea of the pricing you’ll be dealing with.

You can then use a search engine such as LoanConnect to compare many loans from various lenders. However, some of their other products may be worth a shot. Consider their free credit score reports, for example.

Your credit score is obtained directly from Equifax and is updated once a month. When the app is updated, you’ll receive a notification, allowing you to keep track of your score without having to think about it.

MogoProtect Fraud Protection

If you’re worried about identity theft and fraud in our increasingly online world, MogoProtect can provide some relief — for a price.

Mogo will monitor your Equifax report daily for $8.99 per month or $89.99 per year and send you an alert if anything odd occurs. If something does come up, they’ll walk you through some steps you may do to prevent the threat from becoming a full-fledged fraud.

Mogo provides daily monitoring of Equifax credit reports at a price of $8.99/month or at $89.99/year.

Mogo Visa Platinum Prepaid Card

The MogoCard is a one-of-a-kind prepaid card.

You will not be rewarded in the traditional sense. Instead, Mogo will plant a tree for every transaction you make, and you will receive 50 bits of Bitcoin, regardless of the amount you spend.

This card can help you offset your carbon impact if you’re concerned about climate change. Each tree planted will reduce CO2 emissions by around 500 pounds. In a year, the average person produces 44,000 pounds of CO2, which can be offset by 84 transactions.

Those 50 bits of Bitcoin, on the other hand, aren’t worth nearly as much as you believe. Those 50 bits are only worth 4 cents even if 1 Bitcoin costs $80,000.

MogoMortgage

Mogo offers mortgages through their online-only broker if you’re looking to buy a home.

And, assuming there’s no hidden markup, the advertised rates are quite competitive.

I have to admit, they are quite appealing – but given their other credit products’ high-interest rates (i.e. their loans), I’m a little concerned about the terms you’ll have to satisfy and agree to in order to qualify.

Is Mogo a trustworthy and secure platform?

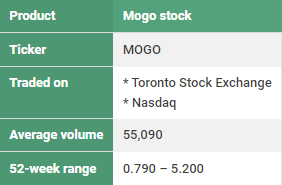

Yes, Mogo is a legitimate, publicly-traded corporation based in Vancouver, Canada. It was started in 2003.

It has been under fire for years because of its high-interest loans, which is understandable, but if you only want to check your credit score or get a new prepaid credit card, you can bypass the source of the majority of the criticism.

One thing to keep in mind is that they will utilize the information you submit to target you with product offers.

If you don’t want organizations to use your information for marketing purposes, you should avoid creating an account altogether.

Is the Mogo loan right for me?

The majority of Mogo loans have outrageously high-interest rates. Even if the rates aren’t as high as payday loan rates, you could end up spending thousands of dollars in interest by the end of the term.

The Bottom Line

At Lionsgate, we specialize in helping people get the extra cash they need, obtain funding for private mortgages, as well as for other real estate transactions. If you are looking to buy land in Canada, get a mortgage or apply for a loan, fill the form below. Or, You can leave us a message and we will try to connect you with local lenders and sources that best meet your needs.

If you found this article helpful, please share it on your timeline and with someone you care about. Also, visit our blog to read similar helpful articles on finance, real estate, and getting mortgages.