During the early days of the mortgage business, brokers would require a lot of paperwork…

Average Credit Score In Canada By Age

Now you can listen to our blog post, “Average Credit Score In Canada By Age” while on the go.

If you are trying to get approved for a loan or mortgage, good credit can help you expedite the process. Good credit allows you to qualify for credit products more easily and with better rates. With low-cost credit, you can save on different financial goals like paying for higher education and buying a house or car. Given the importance of credit scores, it is best to know the average credit score in Canada. Only then, you can ensure its health.

It is tough to predict what credit score will look like in the years to come. Also, you can experience debt issues, job loss or bankruptcy that no one could predict. Although it is never a good idea to compare your finances to someone else’s, it can be beneficial to understand the average credit score in Canada by age.

What is Credit Score?

Credit scores in Canada range from 300 to 900 and indicate your likelihood of repaying debt on time. The higher your credit score, the more likely you are to be approved for credit and to receive reduced interest rates. The information in your credit report is used to determine your credit scores. You can have varying credit scores depending on the information in your credit report and the credit scoring model used.

How Are Credit Scores Calculated?

Consider your credit products (credit cards, loans, lines of credit, and so on) as school lessons to help you visualise things better. What happens if you finish your homework and exams on time? At the conclusion of the semester, you obtain a higher grade. On the other side, if you do not complete your homework or study, your grades may suffer. Next? Your GPA is calculated by adding all of your grades together. When applying to universities and other schools, the higher your GPA, the more likely you are to be accepted into the programme of your choice.

When it comes to your credit scores, something similar happens. When you conduct appropriate credit-related transactions, such as paying your bills on time and in full, your information is reported to credit bureaus*. Credit bureaus, lenders, and other credit score providers utilise this information to calculate your credit scores. In general, the more good information in your credit report, the more probable your credit scores will improve.

Most lenders will consider credit scores between:

660 – 724: as good

725 – 759: as very good

760 – 900: as excellent

What is the Process of Credit Reporting?

TransUnion and Equifax are the two major credit reporting companies in Canada. Your lender reports any credit-related transaction, whether it’s good or bad, to the credit bureau with whom they’ve collaborated. Sometimes both credit bureaus are involved, and other times only one is. Payday lenders, for example, do not report to either credit bureau.

When you report a credit transaction, it appears on your credit report for a set period of time. Depending on how favourable or bad that transaction is, your credit scores may alter.

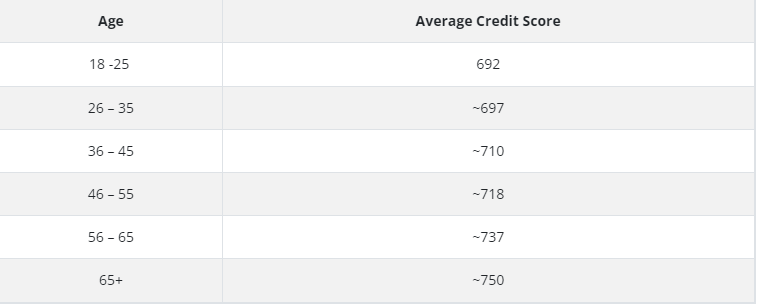

Average Credit Score In Canada By Age

According to Equifax Canada, one of Canada’s major credit bureaus, the average credit score among Canadians has decreased in every age bracket except Generation Z (ages 18–25) over the last ten years. Canadians in the lowest age category (18–25) have a credit score of 692, while those in the oldest age bracket (65+) have a credit score of just over 740. Data also reveals that the average credit score number rises with age.

We believe this is due to the fact that building credit takes time. As you become older, you begin to establish a credit profile that includes a variety of financial items, and your credit history lengthens. These two elements are crucial in determining your credit ratings. As a result, it’s not surprising that the average credit score rises with age. Canadians appear to have an average credit score of above 660, which is regarded as high and healthy.

Practical Tips for Average Credit Score by Age in Canada

As previously stated, everyone’s financial journey is unique, but there are a few times in everyone’s life when credit score advice is essential.

Ages 18-24

Younger Canadians typically do not have extensive credit histories because they have only recently obtained their first credit product or have not applied for as many different types of credit. This can make it harder to establish a good credit history. It’s to your best advantage at this stage in your life to start developing good financial habits and only utilise credit that you can afford to repay. This will help you create the credit you’ll need later on when you’re ready to apply for larger, more expensive loans.

Ages 25-35

Most people start getting married, buying vehicles, mortgaging their homes or upgrading to more expensive apartments/condos around the age of 30. All of these life paths are likely to be the most costly. For example, housing expenses have been growing across the country. And, of course, if you have children, they will not become financially self-sufficient for a long period.

This is the age group in which saving should take precedence over other concerns. You’ll also need a good credit score at this time because you’ll require access to a variety of loans at the best prices. You should also consider paying off any consumer debt you may have and making sure you’re not overborrowing.

Ages 45-54

Retirement is probably on your thoughts at this stage in your life, even if it isn’t a realistic option for most individuals in this age bracket. By the time you’re in your mid-40s, you should have figured out how to save and spend properly. Furthermore, you should have paid off the majority of your auto loan and home. Your children are likely to have their own careers and may even be ready to move out, and you should have put money into your RRSP.

Ages 55+

Most people’s cars and mortgages are paid off by this time, and their children have careers, families, and lives of their own. Many retirees downsize to a pleasant condo or assisted living facility after selling their homes. Many retirees even relocate to locations with warmer weather, where heating and other utility costs are lower.

All things considered, there should be fewer bills to cover when you approach this age. While high credit ratings are important, you’ll likely be more concerned with continuing to prepare for retirement and devising a strategy to ensure that your money lasts as long as you need it.

Need Some Quick Cash With Bad Credit? Let Us Help!

Are you struggling with your financial needs and need some extra cash? Lionsgate can help. Just fill out the form below, letting us know all your cash or mortgage requirements and we will find the best lender for you. Amazing thing? The process is free and you can quit it at any time.

We have a team of experts that analyze your requirements and pick the best lender for you, with prudent advice.

Note: Please give your authentic information while completing the form below.

If you found this article helpful, please share it with someone you care about. Also, visit our blog to read similar helpful articles on finance, real estate, and getting mortgages.