During the early days of the mortgage business, brokers would require a lot of paperwork…

Secured Vs Unsecured Lines of Credit

Now you can read our blog, “Secured Vs Unsecured Lines of Credit: What’s the Difference” while on the go.

You have your savings, and you have your emergency fund as well. But then suddenly something unexpected happens like an accident and your expenses go higher than you thought they would be. In this situation, you will be with no option left but to take a loan.

This is not unusual as everyone needs extra funds once in a while. However, it is important to understand the differences between the types of credit or loans available and manage the credit you do have in a responsible way.

For many people, a line of credit (LOC) is the first source of funds when needed in an emergency. But, what exactly it is?

Read More: Private Mortgage Loans For Short Term

What is Line of Credit (LOC)?

A line of credit (LOC) is an arranged money of standing credit that is available for you to use at any time until you do not exceed the allowed limit. A fair advantage of LOC is that you can continuously borrow and repay up to your predetermined limit.

Compared to a loan, a line of credit gives you more opportunities. For instance, in a line of credit, you only pay interest on the money you actually use. So, if you have a $50,000 LOC and you use only $5,000, your interest will be only on that $5,000. It is one of the reasons why LOC is popular when it comes to emergency funds.

Not only this, but a line of credit is also reusable. This means that you need to apply only once. If approved, you can access any amount of the credit line at any time. Also, the rate of interest on LOC is usually lower than that on credit cards.

A line of credit (LOC) is mainly divided into two types: A secured line of credit and an unsecured line of credit. Let’s take the secured line of credit first.

Secured Line of Credit

Secured Line of Credit

A secured line of credit also termed as a home equity line of credit (HELOC), is backed by the equity in your house. In this, the risk to the lender is low; so, the interest rate is lower as well. In secured LOC, the monthly payments are low and the amount limit is high. In fact, if you use a substantial amount of credit, you can save hundreds of dollars a year with a secured LOC.

Thus, if you need a greater amount of credit and have equity to back it, consider a secured line of credit.

Unsecured Line of Credit

If you have nothing to back your credit and need a short loan, an unsecured LOC is probably the only choice for you. In this, the interest rate is higher as the lender takes the risk of his money. One great thing about unsecured LOC is that you do not need any fee to set up. Also, the maximum borrowing amount is $50,000 – which can cover a lot of your finances.

This type of credit is ideal for the lower-priced needs and those looking to consolidate multiple high-interest credit cards or loans into one low-interest option.

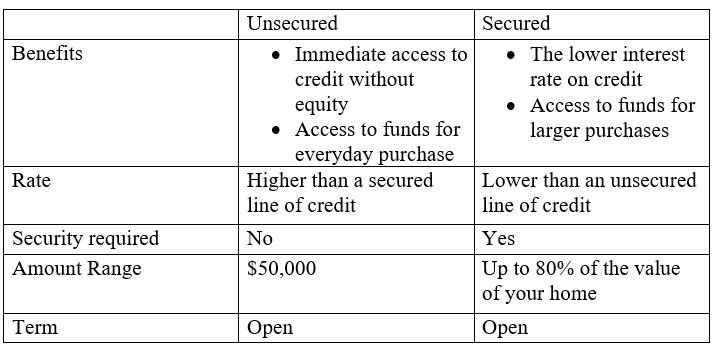

For a fair comparison, let’s discuss the traits of each.

Secured Vs Unsecured Lines of Credit

Given the characteristics of lines of credit, you might already be wondering how it is different from a personal loan. If yes, keep reading as we are about to explore what is the difference between personal loans and lines of credit, and what you should pick – if you have to.

You May Also Like: Housing Bubble: Will Real Estate Market Crash?

Personal Loans Vs Lines of Credit

If you don’t know what a personal loan is and how it works, read our detailed guidelines here.

For the sake of this very article, know that a personal loan is best for making a large one-time purchase with the fixed or variable interest rate option. The minimum loan amount with a personal loan is $3,000. However, the maximum limit depends on your credit score and a few other factors. Also, the repayment options start from weekly, bi-weekly, semi-monthly, and monthly payments. The payment is a combination of principal and interest.

Similar to lines of credit, personal loans have secured and unsecured types as well. Secured loans are backed by collateral and yield higher amounts with low interest. Whereas, unsecured loans are short in amount and have a higher interest rate.

However, a personal line of credit is for the varying borrowing needs. If you need to make an ongoing purchase, a personal line of credit is probably a better fit. A personal line of credit is reusable – that means if you are approved once, you can access any portion of the credit line at any time.

Also, the minimum borrowing limit is way lower than a personal loan. So, if you need a loan of less than $13,000, consider taking a personal line of credit.

The Bottom Line

A personal line of credit can help you pay off your other debts with flexible payments and competitive interest rates while providing ongoing access to available credit for future use. Whereas, a personal loan is for the immediate upfront funds to pay for a one-time purchase. You can pay off your loan at any time without any fees or charges.

At Lionsgate, we specialize in helping people obtain funding private mortgages for land purchases as well as for other real estate transactions. If you are looking to buy land in Canada, leave us a message and we will try to connect you with local realtors and sourcing for financing.